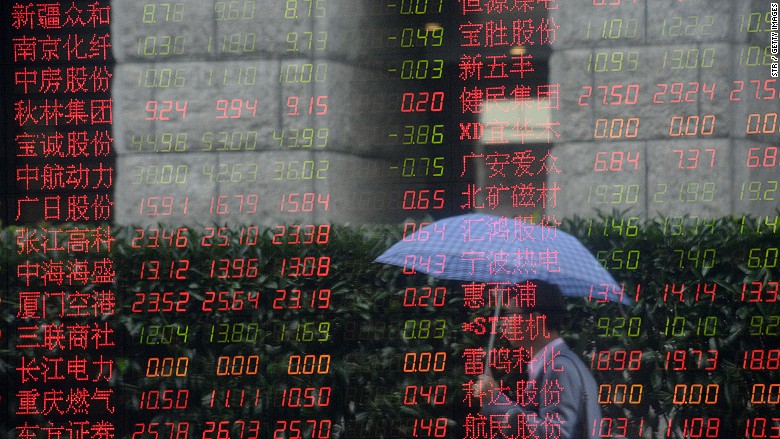

China’s dangerous path

August 16, 2017 | Expert Insights

The International Monetary Fund (IMF) has branded China’s credit-fueled economic strategy as “dangerous.”

IMF has warned that China’s current path could risk a sharp slowdown in growth in a sharply worded report in August 2017.

Background

China is the second largest economy in the world after USA. According to certain forecasts, its GDP growth is slated to overtake America’s GDP in another 10 years. A hub for manufacturing industry, China is the fastest growing economy. Its economic growth has been over 10% for over 30 years.

However, in the recent years, China’s exponential growth has come at the cost of increased debt. According to statistics, its debt is more than 250% of the GDP and is much higher than the US. It is, however, lower than Japan, which remains the world’s most indebted leading economy. Experts have said that if China’s trajectory continues, then it will be looking at an economic slump sooner than later.

IMF has revealed, “Nominal credit to the nonfinancial sector more than doubled in the last five years, and the total domestic nonfinancial credit-to-GDP ratio increased by 60 percentage points to about 230pc in 2016.”

Analysis

According to the IMF report, China must immediately address its debt problem or risk hurting its economy. In a report, IMF experts note, “International experience suggests that China's credit growth is on a dangerous trajectory, with increasing risks of a disruptive adjustment and/or a marked growth slowdown.

In the immediate future, China is still looking at robust growth but this is likely to change. The IMF report has said this economic growth will come at the cost of “large and continuous increases in private and public debt, and thus increasing downside risks in the medium term. China has the potential to sustain strong growth over the medium term. But to do this safely requires accelerating reforms to rebalance towards less credit-intensive growth, while using still-sizeable buffers to smooth the transition”

The report states that China’s debt as a proportion of gross domestic product is likely to increase to 300% by 2022. Experts are thus calling on the nation to begin work towards addressing the problem. The report states, “However, risks around this baseline have also increased. The main cost of this stronger growth outlook is further large increases in public and private debt. Such large increases have internationally been associated with sharp growth slowdowns and often financial crises.”

Assessment

Our assessment is that China’s economy will expand at an average pace of 6.4% from 2017 through 2020 compared to the 6% estimate a year earlier. President Xi Jinping has been pushing financial regulators to address excessive borrowing at state enterprises and has said that their indebtedness is a “priority of priorities.” However, the addiction to debt requires measures that include allowing companies to fail and sweeping shifts in the way capital is allocated that policy makers have yet to embrace.

Read More:

Comments