China on a downturn?

September 22, 2017 | Expert Insights

Standard & Poor Ratings has downgraded China’s long-term sovereign credit from AA- to A+.

Background

China is the second largest economy in the world after USA. According to certain forecasts, its GDP growth is slated to overtake America’s GDP in another 10 years. A hub for manufacturing industry, China is the fastest growing economy. Its economic growth has been over 10% for over 30 years.

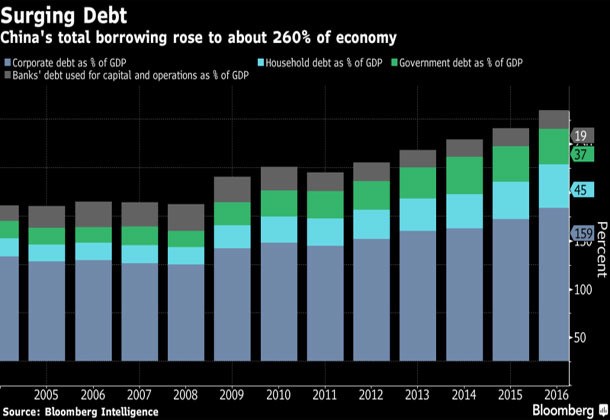

However, in the recent years, China’s exponential growth has come at the cost of increased debt. According to statistics, its debt is more than 250% of the GDP and is much higher than the US. It is, however, lower than Japan, which remains the world’s most indebted leading economy. Experts have said that if China’s trajectory continues, then it will be looking at an economic slump sooner than later.

IMF has revealed, “Nominal credit to the nonfinancial sector more than doubled in the last five years, and the total domestic nonfinancial credit-to-GDP ratio increased by 60 percentage points to about 230pc in 2016.”

Analysis

Due to China’s increasing build-up of credit, Standard & Poor Ratings has downgraded China’s long-term sovereign credit by one step. The nation’s credit has gone from AA- to A+.

Kim Eng Tan, an S&P senior director of sovereign ratings explained the company’s decision noting, “Despite the fact that the government has shown greater resolve to implement the deleveraging policy, we continue to see overall credit in the corporate sector to stay at a 9 percent point. We’ve now come to the conclusion that while we do expect some deleveraging in the next few years, this deleveraging is likely to be much more gradual than we thought could have been the case early this year.”

The Bank for International Settlements has revealed that nongovernment debt in China rose in 2016 and was equivalent to 257% of the annual economic output. It is 143% higher than what it was in 2008. Experts state that this is unusually high for a developing nation like China. The A+ rating is still one of the highest ratings given by S&P.

China’s government has responded by noting that S&P did not give the country due consideration before the downgrade. "The Standard & Poor's downgrade of China's sovereign credit rating is a wrong decision," the Finance Ministry said on its website. "This misreading neglects China's good fundamentals and development potential." The ministry also said that company did not take into account the nation’s economic growth and reform efforts. Estimates have declared China’s economy will expand at an average pace of 6.4% from 2017 through 2020 compared to the 6% estimate a year earlier.

Assessment

Our assessment is that this is China’s first downgrade by S&P since 1999. This may be good news for the bulls. With the Communist Party Congress slated to begin in a month’s time, we feel that the Chinese officials will be focused on keeping the financial markets buoyant. We believe large state-backed funds will probably buy rather than sell Chinese bonds and stocks. The power of the Chinese state was demonstrated after a similar downgrade by Moody’s investor service in May 2017. Any loss on Chinese stocks was squared off in a single trading session and the Yuan climbed to a seventh month high in offshore trading within a week.

Comments