China appeases US trade concerns

March 17, 2019 | Expert Insights

China is to implement a new Foreign Investment Law in 2020, seeking to assuage US concerns over technology and intellectual property rights. The law embodies a watered-down version of a 2015 draft by China’s Ministry of Commerce.

Background

The United States and China are two of the largest economies in the world. Both countries consider the other as a partner in trade and an adversary in geopolitics. US President Donald Trump has been a vocal critic of Chinese trade policies and has called for a revamp in how China engages in world trade. He blames the country for loss of jobs within the US and has often criticized the US trade deficit with China, which widened in 2017. The resulting trade war saw the US imposing tariffs on $200 Billion worth of Chinese exports and Beijing responding with tariffs worth $59 billion on key US agricultural exports such as soybeans. Despite this, China's total foreign trade volume maintained rapid growth.

At the heart of the US-China trade and technology dispute are local requirements in China that force foreign companies to transfer proprietary and intellectual technology to their Chinese partners. Foreign companies protest such requirements which force them to operate through joint ventures with Chinese companies, forcing such transfers. These foreign investors assert that Chinese partners eventually compete against them using their own technology. In January 2019, state-sponsored Xinhua news agency reported that the Chinese government will rush through a new foreign investment law in order to aid trade talks with Washington. Beijing seeks to assuage fears as its economy shows signs of a downturn.

In recent years, Chinese security forces have gained greater jurisdiction over a range of Chinese issues, including foreign activity in the country.

Analysis

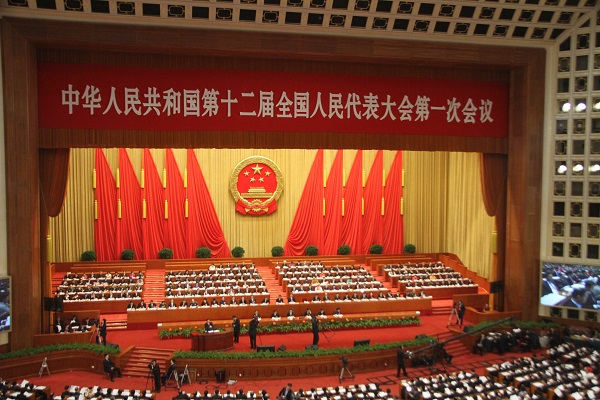

On March 15, 2019, China’s National People’s Congress passed the Foreign Investment Law that seeks to grant foreign companies equal-standing with Chinese state-owned enterprises. The law is based on a 2015 version drafted by the Ministry of Commerce. Beijing hopes that the law will keep foreign investment flowing into the country by soothing the concerns of foreign businesses. The new rule goes into effect on January 1, 2020. Some estimates state projects that the law could facilitate $1.5 trillion in inbound investment over the next decade.

The law outlines a “negative list” wherein sectors not explicitly declared closed to foreign businesses are assumed open to foreign investment. Previously, a sector had to be officially designated as open before a non-Chinese company could invest.“If we make a promise on opening up, we will certainly deliver,” Chinese premier Li Keqiang said of the changes long sought by the US. The law includes avenues for foreign organizations to air complaints by streamlining the enforcement of bilateral investment treaties.

While the law has been welcomed as a step in the right direction, many analysts and business experts have protested that the law omits many details that the 2015 draft contained. Foreseeing hidden impediments being written into more detailed regulations implemented in support of the law, analysts estimate that the law is potentially a measure to “show sincerity in trade negotiations.” Some Chinese-centric international business associations have voiced concerns over the lack of input from industry stakeholders.

The use of vague definitions is of particular concern, especially in light of greater involvement by security forces in issues pertaining to foreign investment in China. It is conceivable that the concerns of Chinese security forces shade the definition of crucial aspects in terms of national security, thereby carrying the potential of a greater impediment to foreign investment.

Simultaneously, China’s private businesses have been hit by lending restrictions amongst other measures, while Beijing seeks to ensure the vitality of its larger state-owned entities. Zhao Yanqing of the Liaoning province Chamber of Commerce and Industry, a government backed association for private companies, said, “There’s a feeling you should take care of your own children first.” The statement highlights a worry by local businesses that the new law donates advantages to foreign businesses that indigenous businesses cannot compete with.

Assessment

Our assessment is that China’s Foreign Investment Law is aimed at alleviating US concerns regarding China’s technology and intellectual property infringements. We believe that the lack of critical definitions demonstrates that the law is to be employed as a part of negotiations in securing a new trade deal with the US, amid trade tensions with Donald Trump.

Comments