CAPPING THE RUSSIANS?

December 10, 2022 | Expert Insights

Facing a recalcitrant Russia, which appears to shrug off all the economic sanctions that the West had piled upon it, the G7 was expected to take measures to stop Mr Putin from making profits despite the host of bans.

This was amply made clear on December 5th when the G7, the EU, and Australia imposed a $60 cap on Russian crude exported by sea. The aim is to keep Russian crude prices at least 5 per cent below the price of Russian crude fixed by the International Energy Agency (IEA). A slew of penalties has been fixed for ship operators transporting Russian crude above the cap price.

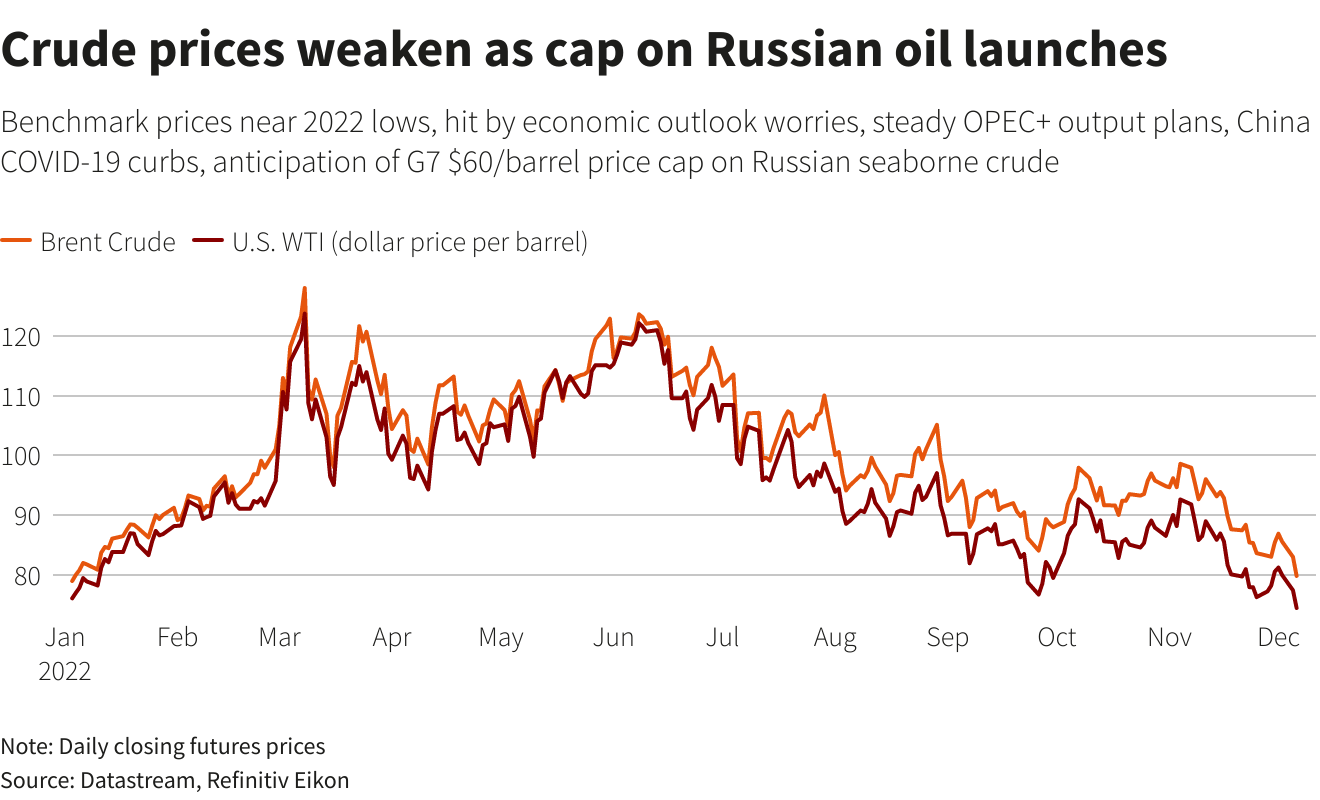

There was a sharp increase in oil prices following the plan's implementation with global oil benchmarks, Brent and West Texas Intermediate crude, increased by 60 to 70 cents a barrel.

Background

Along with the EU's ban on seaborne imports of Russian crude and comparable commitments by the United States, Canada, Japan, and Britain, the price restriction will be enforced by the G7, the European Union, and Australia.

Only when the cargo is purchased at or below the price cap is it permitted to transfer Russian oil to third-party nations utilising G7 and EU ships, insurance firms, and financial institutions. Because the main shipping and insurance businesses in the world have their headquarters in G7 countries, the cap may make it difficult for Moscow to export its oil at a higher price.

Expectantly, Russia, the second-largest oil exporter in the world, declared that it would not accept the restriction and would not sell oil that is subject to it.

Analysis

The ban applies to more than two-thirds of the EU's purchases of Russian oil. The President of the European Council, Charles Michel, described the restriction as a sign of the unity of the EU and claimed that it puts "maximum pressure on Russia to halt the war."

The EU's oil embargo covers EU companies that finance and insure ships carrying Russian crude oil around the globe, but it does not cover imports of Russian oil through pipelines. Germany, Poland, and Austria have pledged to stop importing Russian oil by the end of this year to support the prohibition.

However, because of their continued reliance on Russian pipeline oil, Hungary, the Czech Republic, Slovakia, and Bulgaria will be permitted to keep importing it while establishing alternate sources of supply. However, the European Commission has stated that these pipeline imports cannot be transferred to other EU countries or non-EU countries.

India has decided to not only continue with but even double its trade with Moscow in the "near foreseeable future" despite the sanctions put in place by the United States following Russia's invasion of Ukraine. India's position on any such pricing cap system is to remain neutral.

Predictably, the oil markets are bound to get into turmoil as Russia, pushed to a corner, may cut down its oil exports. Import-dependent nations like China and India would especially be impacted as, in the case of India, 80 per cent of its energy needs are imported.

The dramatically increased imports of Russian crude at reduced prices by India are mostly to blame for the growth in trade volumes between the two nations. Before the Russia-Ukraine war, India imported less than 1 per cent of its total crude from Russia; today, it buys more than 20 per cent of its overall needs. Iraq and Saudi Arabia were India's top two oil suppliers, and their imports of crude account for about 21 per cent and 16 per cent of India's total imports, respectively.

Assessment

- The cap won't significantly affect Moscow's oil profits in the short term. In response to the restriction, Russia claimed that its "special military operation" in Ukraine would not suffer financially. The actual impact will be visible only after about 60 days once the buyer nations are forced to replenish their stocks and fresh sea-borne oil procurement has to take place.

- Prices might soar if Moscow follows through on promises to reduce output rather than selling oil to nations adhering to the cap, and that is where things could get complicated for the United States and its G7 partners. The OPEC countries will stand to gain as they are not under any price cap.

- India and China purchased Russian oil at steep discounts as the G7 developed its plan, and they are anticipated to make significant additional purchases outside the price cap. However, they risk attracting penalties and secondary sanctions if they are too blatant about discarding the G7 cap. It’s a path to be treated with caution.

Comments