CAPPING THE RUSSIANS

November 5, 2022 | Expert Insights

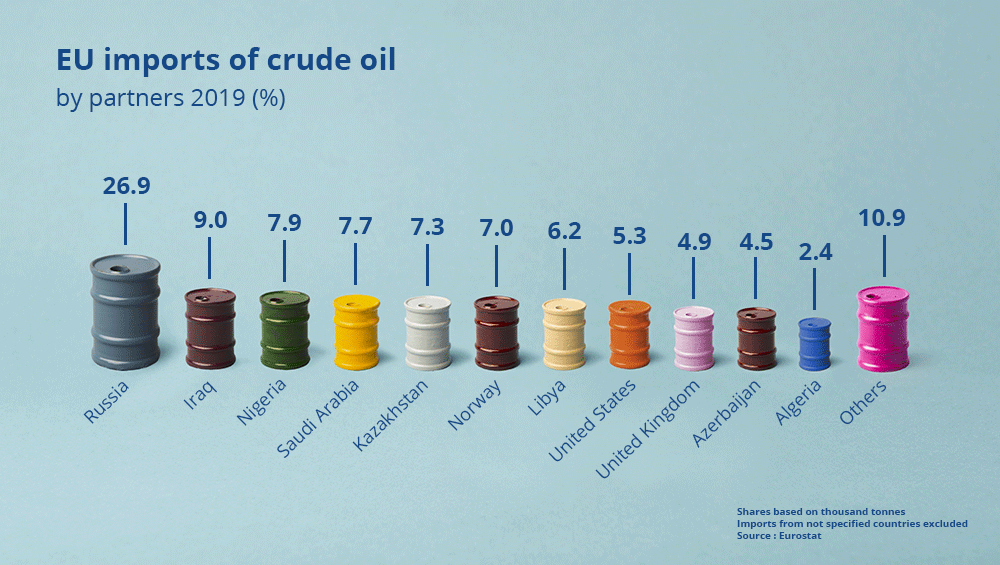

Although crude oil prices are returning to pre-Russian invasion levels, they continue to be volatile due to persistent ambiguous economic trends. To reduce Russian oil revenue, the G7 leaders suggested capping the price of oil. Prices remain erratic due to a potential reduction in non-OPEC supplies and the ongoing energy crisis in Europe.

Background

Recently, the Group of Seven (G7) finance ministers announced the adoption of a price cap on petroleum products and crude oil of Russian origin. Under the proposed rule, it will be illegal to offer services for the marine transportation of crude oil and petroleum products of Russian origin unless they are paid for at a specific price or less (to be determined).

The U.S. Office of Foreign Assets Control (OFAC) has claimed that this Price Cap will firstly maintain a reliable supply of Russian seaborne oil to the global market, secondly reduce upward pressure on energy prices, and last but not least, reduce Russian earnings from the inflated global energy prices. Individuals and companies of the G7 nations (and those coalition countries that also sign up) will be forbidden from providing services for the marine transport of such products if Russian-origin crude oil and petroleum products are purchased over the Price Cap price. The relevant G7 services are not prohibited, but the purchase is still allowed. According to the OFAC guidelines, the Price Cap appears to rely on a record-keeping and attestation procedure that enables every party in the supply chain of seaborne Russian-origin crude oil or petroleum products to prove or confirm that the oil or petroleum products have been bought at or below the Price Cap price.

Although not all 27 of the EU's member states have endorsed the measures, the European Commission supports the Price Cap. The G7 nations—Canada, France, Germany, Italy, Japan, the United Kingdom, and the United States—will sign the Price Cap first. The remaining EU member states have also been invited to support the Price Cap, and Australia has already indicated its support. The Price Cap will go into force for crude oil on December 5 2022, and petroleum products on February 5 2023, according to OFAC. This is in addition to the Russian oil embargo imposed by the EU, which goes into effect on the exact dates.

Analysis

A budget cap might help lower oil prices globally over the long run, but it might cause extremely volatile prices shortly. The application of a price ceiling on Russian oil is trickier than usual, given the current geopolitical environment and the oil market, which were finalised last week in Washington by senior officials from the G7 states. The unofficial oil price range of US$40-75 per barrel of Brent (Pb) was maintained for most of the former U.S. President Donald Trump's administration through a combination of threats (of the U.S. military's withdrawal from Saudi Arabia and the passage of 'NOPEC' legislation, in particular) and rewards (the continued assurance of Saudi Arabia's security and U.S. companies' investments in the country).

Assessment

- This oil price cap was created with two opposing ideologies in mind. Thus, its strict enforcement is far from guaranteed. The G7 wants to restrict the amount of money Russia can get from each barrel of oil rather than halting all oil shipments from Russia.

- The group also wants to involve China and India, but it is highly improbable given that both nations have been buying Russian oil at steep discounts. Russia keeps its oil revenue after the oil embargo by the West by increasing shipments to India and China.

Comments