Bitcoin fizzles

December 28, 2017 | Expert Insights

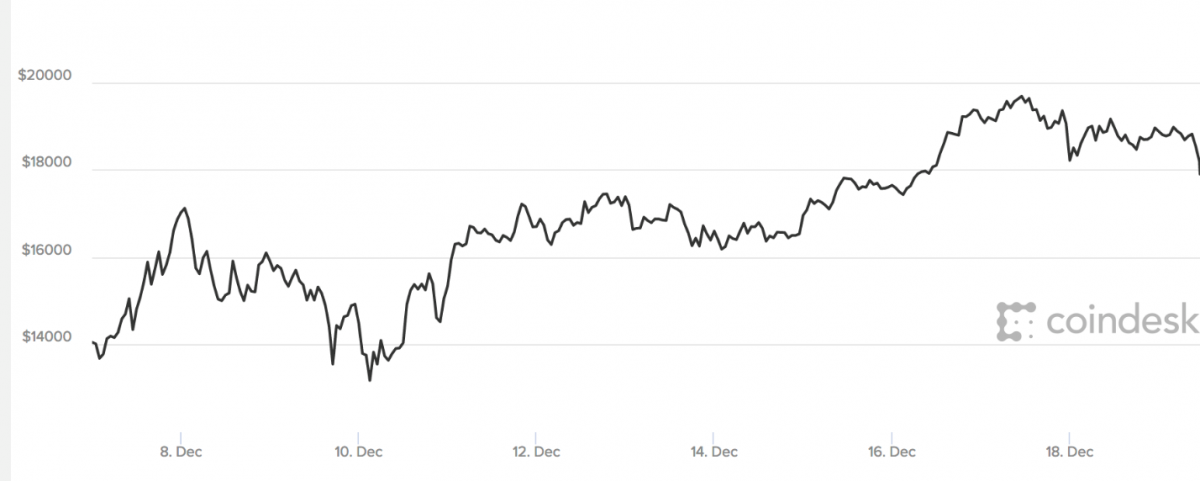

The value of Bitcoins has fallen by nearly 25% after nearly touching $20,000 recently. The prices dropped below $15,000 in the span of 12 hours.

Experts have warned of a “bubble” regarding Bitcoins that could trigger another financial meltdown.

Background

Cryptocurrency is a digital asset (in other words a form of digital money) that is designed to stay secure. It uses cryptography to secure its exchanges making it nearly impossible to counterfeit. Cryptocurrency in particular is classified as a subset of digital currencies. Bitcoin was the first decentralized cryptocurrency.

Bitcoin is a community-run system. It has often been referred to as the first “start-up currency”. By the beginning of 2015, there were 100,000 merchants and vendors who accepted Bitcoins as payment. Bitcoins have been used in illegal trade online as well. Critics argue that digital cash systems are volatile and speculative in nature and comes with a number of inherent risks.

In 2017, the value of Bitcoins began to exponentially rise in the markets. The cryptocurrency reached $3,451.86 (£2,651) per coin during trade on August 7, 2017 and has continued to grow since. On October 20th, 2017, Bitcoin surged to a record high of more than $6,000. In January 2017, Bitcoin was valued at only $1,000.

By December 2017, the value of Bitcoins had risen to an unprecedented high. In the span of one week, the value jumped by 67%.

Analysis

The value of Bitcoin reached an all-time high of $19,783 reported on December 17th, 2017. However, just days later, the value plummeted by more than 25%. The prices dropped below $15,000 in the span of 12 hours.

The drop in prices comes just days after a South Korean cryptocurrency had to declare bankruptcy after it was hacked and 17% of its assets were stolen. The exchange, called Youbit, had been hacked once before in April when nearly 4,000 bitcoins were stolen in a cyber-attack that the country’s spy agency linked to North Korea.

This is the second major hacking that has taken place in the recent weeks. Nearly $64m of Bitcoin was stolen by hackers who broke into the Slovenian-based bitcoin mining marketplace NiceHash. These hacks have highlighted concerns about security amid booming trade in bitcoin and other virtual currencies.

Opinions on cryptocurrencies like Bitcoin are deeply divided among experts. In September 2017, JPMorgan Chase CEO Jamie Dimon called bitcoin "a fraud.” Some have opined that it looks like an unsustainable bubble. Countries like China have tried to curb the rise of cryptocurrencies by banning cryptocurrency exchanges, but nothing has deterred Bitcoin’s rise.

Stephen Innes, head of trading in Asia-Pacific for retail FX broker Oanda in Singapore, told Reuters that there have been moves out of bitcoin into Bitcoin Cash, a clone of the original cryptocurrency. “Most of it is unsophisticated retail traders getting burned badly,” Innes said on Bitcoin’s recent retreat.

Assessment

Our assessment is that the drop in the value of Bitcoins is likely in part due to market correction but also in part due to the recent breaches of cryptocurrency exchanges. These hacks have highlighted that the largely unregulated cryptocurrency market is also vulnerable to breaches that could destabilize markets further.

Comments