Asian markets see red

February 9, 2018 | Expert Insights

Taking a cue from the Wall Street plunge, Asian markets sharply declined on February 9th, 2018. Experts now believe that the global stock markets have now entered into correction.

What happens if this correction turns into a bear market?

Background

The Dow Jones Industrial Average is a stock market index founded in 1885. The first industrial average was calculated on May 26, 1896. The index is owned by S&P Dow Jones Indices (owned by S&P Global). It is an index that shows how 30 large publicly owned companies based in the United States have traded during a standard trading session in the stock market. Like every other market index, it goes through a period when it is on the rise and it goes through a period when it is on the decline. A period when there is an increase is referred to as the ‘bull’ market and when there is decline, it is called a ‘bear’ market. Since 2009, Dow has been experiencing a bull market.

In 2018, the Dow Jones reached an all-time high of 26,000. However, soon afterward, the stock market began to decline. In February, it witnessed its steepest fall in six years. The decline was mainly due to large US tech companies like Google, Exxon Mobil, Apple and Chevron reporting weak earnings. The immediate global markets around the world experienced a sharp decline, thus sparking a world-wide sell-off. Stock markets around the world suffered steep falls and nearly $4 trillion have been lost within days.

Analysts have blamed a number of factors of the sell-off including stock market correction and the underperformance of top American companies like Alphabet and Apple. Experts have also stated that it could be a result of algo trading.

Analysis

On February 8th, 2018, Dow Jones closed 1,032.89 points lower at 23,860.46. The 30-stock index also closed at its lowest level since November 28th. "This whole correction is really about rates. It's really about inflation creeping up. It's really about people thinking the Fed is either behind the curve or actually has to be more aggressive," Stephanie Link, global asset management managing director at TIAA.

Asian markets fell sharply right after the Wall Street decline. Losses were led by the Chinese markets that plunged 5.5% on February 9, 2018. Tokyo's Nikkei 225 was off 3.2% at 21,180.28, and Hong Kong's Hang Seng fell 4.2% to 29,142.87. Australia, South Korea and Southeast Asia also witnessed steep losses. With Friday's drop, the Hang Seng Index gave up its gains for 2018, dropping 1.6% since the beginning of the year. India’s Sensex crashed by 400 points as well.

The market performance came just hours after the Bank of England revealed that it could be increasing the interest rates in UK in the months to come. “There’s some big-money players that have really leveraged to the low rates forever, and they have to unwind those trades,” Doug Cote, chief market strategist at Voya Investment Management, told Bloomberg News. “They could be in full panic mode right now.”

Chris Weston, chief market strategist at the online trader IG in Melbourne, said volatility was the main problem. “You could wake up and the Dow is down another 1,000 points, or it could be up,” Weston said. “There’s no certainty. Markets like certainty but the only certainty at the minute is of a big move and that could be up or down.”

“Tokyo shares had fallen to a level that was attractive for buying, but investors refrained from doing so after seeing a wild correction in the US market,” Masahiro Ichikawa, a senior strategist at Sumitomo Mitsui Asset Management Co. told Kyodo News.

Jim Rogers, American entrepreneur has said that the next bear market will be the “worst in our lifetime.” "When we have a bear market again, and we are going to have a bear market again, it will be the worst in our lifetime," Rogers, the chairman of Rogers Holdings Inc., said in a phone interview. "Debt is everywhere, and it's much, much higher now."

Assessment

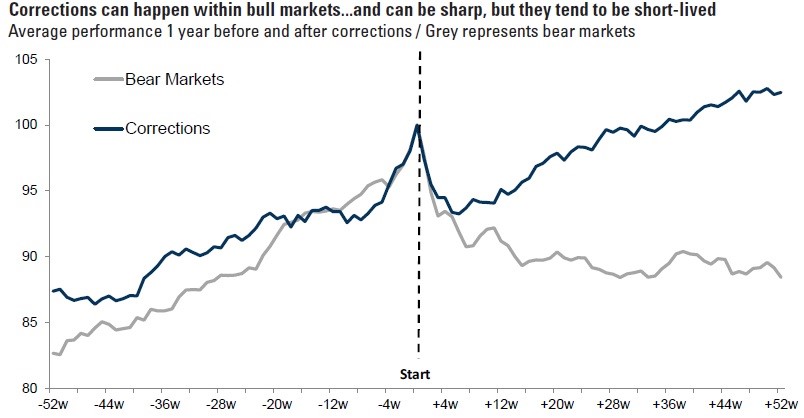

Our assessment is that a bear market would prove to be disastrous to the current global economy. Historically speaking, a stock market correction would be felt globally for a period of four months until markets are able to recover. However, if it deepens into a bear market, then it could take up to 22 months for recovery to take place. As we predicted earlier, we could be at the precipice of yet another financial meltdown.

Comments